You can calculate SOM by dividing your revenue from a previous year by the SAM (Serviceable Addressable Market). This percentage is your previous year’s market share. Now, take your market share percentage and multiply it by this year’s SAM.

Full Answer

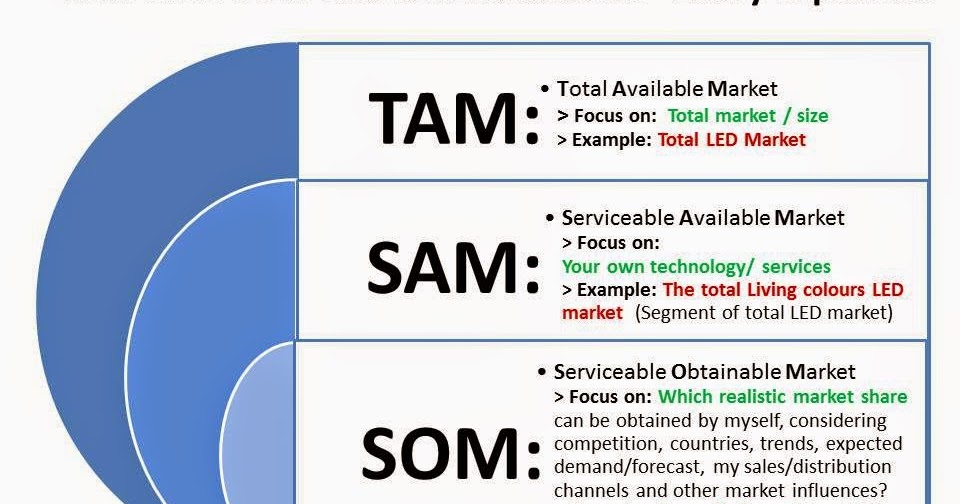

What do Tam Sam and Som mean in market analysis?

Oct 15, 2021 · How Did Blackboard Calculated Tam Sam Som October 15, 2021 by Admin If you are looking for how did blackboard calculated tam sam som , simply check out our links below :

How to calculate Sam?

Mar 21, 2020 · A strategy to calculate the market size: TAM, SAM, and SOM Make no mistake, size does matter. Although it is not something that should obsess us if a minimum is necessary.

What is the formula for calculating the Tam of a business?

Feb 18, 2022 · You could therefore calculate your TAM as: 6000/5 = 1200 (to calculate the overall number of vendors to potentially purchase 5 barrels annually) 1200 x $28,000 = $33,600,000

How to calculate total addressable market (TAM)?

May 08, 2020 · 3. Incorporate your business pricing model (TAM SAM SOM) Assuming that your MSRP (including landed cost) is $458 per product. Then your TAM value would look like below. Total Addressable Market (TAM) Value = Total number of companion animal pet owners in the US * MSRP (including landed cost) = 63.4 million * $458 = $29 billion

How is TAM Som Sam calculated?

You can calculate SAM by counting up all the potential customers in your specific target market. Then you multiply the number of customers by the average annual revenue generated by each customer.Jan 31, 2021

What percentage of Sam is SOM?

This means your SOM is about 6 percent of your SAM. If you're seeking funding, savvy investors will ask you for these items in your business plan, and they'll want you to be able to back up your numbers.

What is the difference between SAM and SOM?

SAM or Serviceable Available Market is the segment of the TAM targeted by your products and services which is within your geographical reach. SOM or Serviceable Obtainable Market is the portion of SAM that you can capture.

Is TAM and market size the same?

TAM looks at the entire potential value of the overall market (think, the total value for toothbrush sales in the United States in a given year). The market size estimation is a huge number, and probably unattainable by one company (unless we're talking about a monopoly).Sep 23, 2021

What is a good som percentage?

For most successful startups, the SOM is a small percentage of the SAM (1–10%). SOM is basically the long-term annual revenue of your startup. Typically, SOM for a great startup is less than 1% of the TAM. If you have a bomb-proof plan for taking on more than 10% of SAM, great — just back it up.Feb 9, 2017

What percentage should SOM be?

It's important to know that most businesses shoot to capture around 1% of their TAM in their first two to three years of operations (although the percentage varies a bit by industry)—this is what we refer to as Segmented Obtainable Market (SOM).

Is SOM a revenue?

The serviceable obtainable market (SOM) is an estimate for the portion of revenue within a specific product segment that a company is able to capture. Factors that contribute to SOM include market size/reach, product, and competition.

What does SOM mean in marketing?

Serviceable Obtainable MarketServiceable Available Market (SAM) - represents the portion of the TAM that can be served by a company's products and services. Serviceable Obtainable Market or Share of Market (SOM) - represents the portion of the SAM that can be realistically captured and served.

What is TAM expansion?

When you ask a VC what they look for in investments, you're likely to get a response that involves going after a large “TAM,” or “total addressable market.” TAM is defined as “the existing revenue opportunity available for a product or service,” and it's often calculated by taking the existing top-down market size and ...Sep 5, 2017

Is Som same as market share?

Served Available Market (SAM): It refers to the share of Total Available Market that the companies providing a specific solution can fulfill. ... Share of Market (SOM): It refers to what a particular company is planning to achieve over the next five years in terms of sales. By definition.Oct 16, 2020

How is TAM calculated for a company?

First, multiply your average sales price by your number of current customers. This will yield your annual contract value. Then, multiply your ACV by the total number of customers. This will yield your total addressable market.Nov 11, 2020

What is a good TAM for a startup?

It's starting to be a big opportunity. For your beachhead market, you should aim for a TAM of $10 to 100 million. If it's more than that, it makes sense to segment it a bit further. If it's less, your beachhead market may not be worth going after considering it's highly optimistic to think you'll get 50% of the market.

A strategy to calculate the market size: TAM, SAM, and SOM

Of course, I am talking about the size of the market, a key variable to understand the potential of a project. But calculating it is not easy: it is difficult to find data and there are several ways to do it … which is the best?

HOW TO MEASURE THE MARKET SIZE WITH TAM, SAM, AND SOM?

TAM — Total Addressable Market (Total or addressable market) It#N#aims to model how big is the universe we are targeting and serves to analyze how big the business opportunity is, or in other words, its total potential if the model later of business pivots.

How to calculate the SOM or market that we can capture?

One of the most common mistakes when posing what our market is like is what is known as the 1% fallacy :

What is a tam?

TAM SAM SOM acronyms and definition 1 TAM or Total Addressable Market is the total market demand for a product or service. 2 SAM or Serviceable Available Market is the segment of the TAM targeted by your products and services which is within your geographical reach. 3 SOM or Serviceable Obtainable Market is the portion of SAM that you can capture.

What is SOM in business?

The Serviceable Obtainable Market (SOM) is your short term target and therefore the one that matters the most: if you cannot succeed on a fraction of the local market chances are that you will never capture a large part of the global market.

What is a total addressable market?

Total addressable market (TAM), also referred to as total available market, is a form of determining the potential size of a market that enables a business to define the holistic revenue opportunity offered from its product or service. It is an exercise that will shed light towards the level of effort and funding to be put into a new business line, because it provides guidelines about the munificence of its economic potential. Nowadays, a TAM has become an important metric and a more creative process of calculating it has emerged due to the increased speed in which new markets are evolving.

What is service obtainable market?

Service Obtainable Market is the subset of your SAM that you will realistically get to use your product. This is effectively your target market that you will initially try to sell to. It should give a more realistic value.

What is the difference between a tam and a sam?

TAM, SAM, and SOM represent the various subsets of a market. TAM refers to the total demand for a product or service that is calculated in annual revenue. SAM stands for Serviceable Available Market, and it is the target addressable market that is served by a company’s products or services.

What is a TAM?

TAM takes into account the products and customer segments that remain untapped by the startup.

Why is bottom up analysis more reliable?

Bottom-up analysis is a more reliable method because it relies on primary market research to calculate the TAM estimates. It uses more reliable data on the current pricing and usage of a product. For example, for a startup company with a free accounting mobile app and annual subscriptions worth $100, it can take a reasonable estimate of the number of businesses in its target market to obtain the TAM.

How does top down analysis work?

The top-down analysis follows a process of elimination that starts by taking a large population of a known size that comprises the target market and using it to narrow down to a specific market segment. Top-down analysis can be represented by an inverted pyramid that shows the large population of a known segment at the top and the narrowed down segment at the bottom. The method uses industry research and reports to get the estimates of the population.

What is the total addressable market?

The Total Addressable Market is one of the essential metrics that startups and existing companies use to estimate the potential scale of the market in terms of total sales and revenues#N#Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. In accounting, the terms "sales" and#N#. When a company is in the process of releasing a new product, a new customer segment, or plan to cross-sell an existing product to existing customers, TAM helps in breaking down these numbers into manageable levels. An investor should be objective in estimating the available market because an exaggerated value may lead to markets with less potential for growth. The ideal market for any entrepreneur is one with potential growth capacity.

What is financial modeling?

Financial modeling#N#What is Financial Modeling Financial modeling is performed in Excel to forecast a company's financial performance. Overview of what is financial modeling, how & why to build a model.#N#requires building a forecast for a company, which is dependent on the company’s total addressable market. When developing or analyzing a forecast in a valuation model#N#Valuation Modeling in Excel Valuation modeling in Excel may refer to several different types of analysis, including discounted cash flow (DCF) analysis, comparable trading multiples#N#, it’s important to perform a “sanity check” against the size of the market. Detailed operating models will typically include a build-up from market size to addressable market, to customers, and finally to revenue.

What is value theory?

Value theory relies on an estimate of the value provided to customers by the product and how much of that value can be reflected in the product pricing. A company estimates how much value it can add and why it should capture this value through the product pricing.

What is a tam, sam, and sam?

TAM, SAM, and SOM can be easily understood with the example of the initial days of Facebook. Facebook was launched with a motive to become a one-stop social media channel for everyone who uses the internet. Its TAM were global internet users.

What is a tam?

In simple terms, TAM comprises everyone who could buy the offering or the maximum amount of revenue a business can earn by selling their offering. TAM is a significant number. It isn’t restrained by constraints other than the offering.

What is SOM in business?

In simple terms, SOM, also called Share of Market, is the realistic fraction of the actual customer market that the business can acquire during the first few years of operation. It considers the competitive, financial, niche, and resources-based restrictions while predicting realistic reach during the initial years of operation.

Why is SOM important?

SOM is of vital importance to both the founders and the investors as it –. Helps business set realistic short-term and medium-term objectives and goals, Helps investors and founders understand the potential of the market, and. Helps the founders make most of their limited resources initially.

What is a tam, sam, and som?

TAM, SAM, and SOM can be useful indicators for early-stage startups and investors to determine the potential revenue, market size and growth of a business. By making the most out of these calculations, anyone involved in early-stage startups will have a better chance of valuating the business.

What does tam mean in business?

TAM is an acronym for Total Addressable Market. Quite simply, TAM is equal to the total possible market demand for the product or service you are selling. This includes the entire universe of potential markets. Investors will want to know the size of a market before investing in any early-stage startups.

Popular Posts:

- 1. what is force refresh submissions in blackboard

- 2. logged onto someone's blackboard

- 3. blackboard quiz log

- 4. build a blackboard at home

- 5. if i drop and add another course when will it appear on blackboard

- 6. file too big for blackboard learn

- 7. can you delete a submitted assignment on blackboard

- 8. how to do reading quiz with blackboard

- 9. montgomery blackboard troy nc

- 10. blackboard assignment tab