, select the Student Financials Tile > Account Services > View 1098-T The first time you retrieve a 1098-T electronically you will need to read the 1098-T consent agreement, check the box indicating that the consent agreement has been read, and then click the green submit button. The next page will list 1098-T forms by year.

What is a 1098-T form?

Dec 15, 2021 · How To Find 1098-T On Blackboard Tidewater Community College. December 15, 2021 by admin. If you are looking for how to find 1098-t on blackboard tidewater community college, simply check out our links below : 1. How do I get my tax form? ... blackboard. 5. Form 1098-T Tax Information – Tarrant County College.

Where do I get my 1098-T from CUNY?

May 21, 2021 · If you are looking for how to find 1098-t on blackboard tidewater community college, simply check out our links below : 1. How do I get my tax form? – MyTCC. https://help.tcc.edu/s/article/How-do-I-get-my-tax-form blackboard. 2. 1098-T Forms – MyTCC – Tidewater Community College

Can I Opt Out of paperless Form 1098-T?

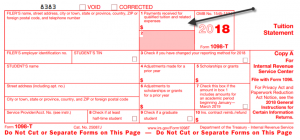

The Form 1098-T, Tuition Statement, is issued to help determine if students or their parents are eligible to claim tax credits under the Tax Relief Act of 1997. Learn more about the American Opportunity Credit or Lifetime Learning Credit by accessing IRS Publication 970. 1098-T Frequently Asked Questions.

Can I access my 1098-T form online?

You can access your 1098-T form by visiting the Tab Service 1098t website.

Where can I find my form 1098-T?

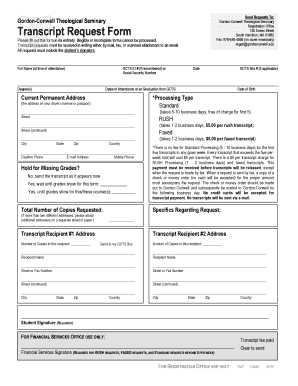

On-Line 1098-T Forms Students can print an electronic 1098T form from their Student Center. Select the "View 1098-T" link on the dropped down menu under Finances on their Student Center. You will need to Grant Consent to receive on-line access or print forms electronically.

How do I download my 1098-T?

Your IRS form 1098-T will only display qualified tuition charges that were paid during the tax year....To view your IRS form 1098-T,Go to MyPCC.Go to the Paying for College tab.Click Student account information.Click View/Print 1098T Tax Notification Form.Enter the Tax Year.Jul 15, 2020

Recent Developments

FAQs: Higher Education Emergency Relief Fund and Emergency Financial Aid Grants under the CARES Act

Other Items You May Find Useful

About Publication 1179, General Rules and Specifications for Substitute Forms 1096, 1098, 1099, 5498,W-2G, and 1042-S

Popular Posts:

- 1. www blackboard cuny

- 2. ctc blackboard chattahoochee tech

- 3. blackboard up for sale

- 4. the blackboard jungle.

- 5. blackboard sign in page

- 6. how to embed links to quizzes in blackboard in blank pages

- 7. taking test on blackboard and maintanance started

- 8. how to you put a google doc onto blackboard site

- 9. blackboard students progress notes about

- 10. how to start a discussion on blackboard