Once logged in you can view the 1098-T by clicking the 1098-T Statement link in the middle of the page. Or, at the top left click on ‘My Account’ select ‘Statements’, then choose 1098-T Tax Statements. The most recent 2020 tax statement will be listed at the top.

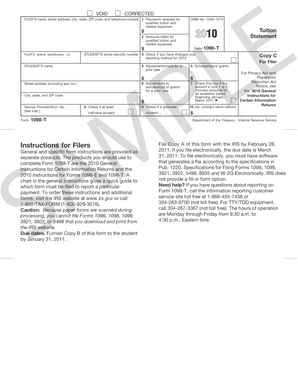

What is a 1098-T tax form?

May 21, 2021 · If you are looking for how to find 1098-t on blackboard tidewater community college, simply check out our links below : 1. How do I get my tax form? – MyTCC. https://help.tcc.edu/s/article/How-do-I-get-my-tax-form blackboard. 2. 1098-T Forms – MyTCC – Tidewater Community College

How do I Opt-in/out to receive my 1098-T electronically?

Dec 15, 2021 · If you are looking for how to find 1098-t on blackboard tidewater community college, simply check out our links below : 1. How do I get my tax form? – MyTCC. https://help.tcc.edu/s/article/How-do-I-get-my-tax-form

How do I get a 1098-T from South Texas College?

Oct 29, 2021 · In Msjc Blackboard 1098-T. October 29, 2021 by admin. If you are looking for in msjc blackboard 1098-t, simply check out our links below : 1. Tax Form 1098-T Information | Mt. San Jacinto College. https://www.msjc.edu/taxform1098t/index.html. blackboard. 2.

What is box 1 on the 1098-T for 2018?

Enter your full first and last names along with the last 5 digits of your social security number. Click 'Submit'. If records are present for you, you will be instructed to create an account (Follow the instructions on the website to create a free account and retrieve your 1098-T).

Can I access my 1098-T form online?

You can access your 1098-T form by visiting the Tab Service 1098t website. UC has contracted with Tab Service to electronically produce your 1098-T form.

How do I download my 1098-T?

Your IRS form 1098-T will only display qualified tuition charges that were paid during the tax year....To view your IRS form 1098-T,Go to MyPCC.Go to the Paying for College tab.Click Student account information.Click View/Print 1098T Tax Notification Form.Enter the Tax Year.Jul 15, 2020

Where do I find my 1098?

Even if you didn't receive a 1098-E from your servicer, you can download your 1098-E from your loan servicer's website. If you are unsure who your loan servicer is, log in to StudentAid.gov or call the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243; TTY 1-800-730-8913).

How do I get my 1098-T from college?

“The student or the student's parents may need to log on to the university's portal or go to the university's accounting department to get the Form 1098-T.”Dec 18, 2020

My 1098-T Feature

The My 1098-T feature allows a student or their parents (if given permission) to view 1098-T information that has been accumulated for a given calendar year in preparation for claiming tuition paid as a tax deduction.

How To

1. From the View My Students feature, click the appropriate student name link.

How to access 1098-T?

Students can view and download Form 1098-T after logging in to their Purdue Career Account. Authorized users can view Form 1098-T through Purdue's secure payment gateway. Students must authorize their parent/guardian to access Form 1098-T specifically.

What is the purpose of 1098-T?

Colleges and universities are required under Internal Revenue Code Section 6050S to issue the Form 1098-T for the purpose of determining a taxpayer’s eligibility for various tax credits and/or deductions.

When is the 1098-T due?

The annual deadline to file the required tax information electronically is March 31, although data may be transmitted earlier. What am I supposed to do with my Form 1098-T? Keep it for your personal records and share it with your tax preparer. Purdue University sends your 1098-T information to the IRS.

Do you have to file a tax return for American Opportunity?

Yes . Section 6050S of the Internal Revenue Code, as enacted by the Taxpayer Relief Act of 1997, requires institutions to file information returns to assist taxpayers and the IRS in determining eligibility for the American Opportunity and Lifetime Learning education tax credits.

What is nonresident alien student?

Nonresident alien students. Students whose qualified tuition and related expenses are entirely waived or paid entirely with scholarships and/or grants.

What is qualified education expense?

For purposes of the tuition and fees deduction, qualified education expenses are tuition and certain related expenses required for enrollment or attendance at an eligible educational institution. The housing, meal plan, orientation, payment plan and other miscellaneous fees are generally not qualifying expenses for tax purposes.

Does Purdue require a 1098-T?

Purdue must file a Form 1098-T for each student enrolled for the given calendar year — and for whom a reportable transaction is made. However, the IRS does not require the University to provide a Form 1098-T for: Courses for which no academic credit is offered, even if the student is otherwise enrolled in a degree program.

Steps to Opt-In to receive your 1098-T electronically

Once logged in Jag-Net a pop-up may automatically appear in order to opt-in to receive your 1098-T electronically.

1098-T FAQs Form

What is a Form 1098-T?#N#All eligible educational institutions must file a Form 1098-T for each qualifying student for whom a reportable transaction is made during the calendar tax year.

Popular Posts:

- 1. lindsey wilson college online class times on blackboard

- 2. does your antivirus think blackboard is a virus

- 3. blackboard login michigan city

- 4. how do i add a journal link on blackboard

- 5. how delete blackboard dropbox entry

- 6. blackboard how to create hyperlink

- 7. blackboard learn course sites

- 8. blackboard submit assignments after due datw

- 9. uma blackboard login

- 10. blackboard copy course content